How to build an excellent credit score in Canada?

Right information at the right time can literally help you save tons of money. In the context of a credit score, we are talking about saving thousands of dollars in terms of interest costs when you take a mortgage loan. We at Experli are proud that all information shared is 100% unbiased and independent. That’s because our content does not promote any kind of affiliate marketing or sponsored advertising. While it is not easy to say no to easy money but our aim is to provide genuine expert local insights to help improve the everyday life of Canadian residents. With this assertion, let us come back to the topic.

What are credit scores?

Your credit score is a three digit number that signifies the level of risk that you pose for a company extending you credit or loan. Your report is allowed to be accessed by financial institutions, car leasing companies, retailers, telecommunication service providers, insurance companies, governments, employers and landlords. Most of the times when you apply for a credit facility, you allow the lending agency to access your credit report by acknowledging their terms.

Your credit file contains information on all your credit accounts like limits, balances, payment history with identification details like age, address, SIN, marital status, spouse details, dependent information, employment history etc.

Who creates your credit report and score?

There are two private companies in Canada: Equifax and TransUnion, who collect, store and share your credit report. The bureaus do not consider your payment history outside Canada even if you are coming from USA. But the silver lining for you is that some lenders may be willing to consider your credit history outside the country. For that you would have to pursue your case directly with the lending agency.

What is a good credit score?

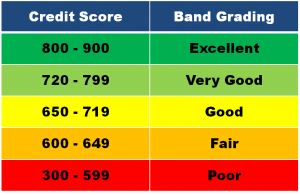

A credit score starts from 300 with the highest score being 900 points. Following are the score bands:

You may be denied a credit facility in case your score lies in the Poor or Fair category. Thus 650 kind of becomes the magic number to qualify for standard loans. However, simply because your TransUnion score is above 650 does not mean you would always qualify for a loan. That’s because the lenders who access your credit history may see a different number than what you see as they apply a specific set of proprietary risk rules to arrive at a final score.

Why is having a good credit score so important?

Loans: Apart from the decision whether to sanction a loan or not, the interest rate that you are charged is also dependent upon your credit score. If your score is high, your credit limit would be higher and the rate of interest charged on a loan facility lower.

Renting a place: Landlords, especially rental apartments check your credit score to assess your tenant worthiness. If you have a low score, you may be refused.

Employment: Some employers are very particular about the kind of employees they hire and may check your credit history. Poor management of credit may make you unsuitable for a job.

Renting vehicles: A car rental company may ask you to give them permission to access your credit report to get a sense of the risk they face in handing over custody of a vehicle.

A poor credit score can make life miserable as it would be very difficult to survive without access to any kind of loan facilities, post-paid phone connections, employment, rental apartments and other things.

How is a credit score calculated?

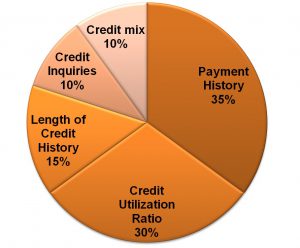

The exact formula to calculate the credit score is kept confidential by Credit bureaus being proprietary information. The broad parameters with their respective weight-age are:

Payment history: 35% of your credit score is impacted by your payment history. This is the single most important factor impacting your overall score.

Credit Utilization Ratio: Also called as the Balance-to-limit ratio, it impacts 30% of your credit score. For example, if you have a credit card with a limit of $3000 and a total outstanding balance of $1000, then you have a Credit Utilization Ratio of $1000/$3000 = 33%

Length of credit history: About 15% of your score is impacted by the length of your credit history. A long credit history makes you a less risky borrower.

Credit inquiries: 10% of your credit score is impacted by the number of recent inquiries into your credit account.

Credit mix: Rest 10% of your credit score is influenced by the variety of your credit accounts. Credit accounts can be various types like a credit card, line of credit, car loan etc.

How to check your credit score?

There are various methods to check your credit score for free. You can directly order a copy of your credit report from Equifax Canada or from TransUnion Canada. You can order by mail/fax using this Equifax form or TransUnion form. Or you can order through telephone by calling Equifax on 1-800-465-7166 or TransUnion at 1-800-663-9980. In both cases you will receive your credit report by mail. TransUnion allows you to order your credit report online for free once every month. However Equifax will charge you to view your instant report online.

Your banking partner may also provide you access to free credit reports. In case you bank with RBC, they have a option to let you view your credit score from TransUnion. You have to login into your internet banking account in a browser for that.

Then there are third party service providers like CreditKarma- which is a very popular option used by people to check their credit scores. However, most users are surprised when the actual credit decision is not reflective of the score that they see via such third party providers. To keep things simple, there are two popular models used in calculating a credit score: FICO and VantageScore. For example the model described in this article above is the FICO model- which is generally used by lenders (90% of them by some reports). But the scores shown by third party providers are mostly based on VantageScore and do not reflect your FICO score. Thus if you want to see you genuine FICO score, you are best placed to seek your free copy directly from the Credit Bureaus.

How to build an excellent credit score quickly?

Building an excellent credit score is not an easy task. It requires expert guidance along with sustained diligence to follow it. Here are some of the things you can do to build an excellent credit score:

Paying all your bills on time: Since 35% of your score comprises of payment history, this cannot be stressed enough. In today’s world we have a huge variety of bills like telephonic, utilities, internet, credit cards, home loans, auto loans, lines of credit and it is very easy to miss on one of them. The best solution remains linking an automatic debit system to your bank account. Almost every bank provides a mechanism to achieve that. It may be onerous but get it done right away.

Also, you may want to clear your entire outstanding balance instead of just the minimum amount due. Also pay a little earlier than the due date as that shows you are not living on the edge.

What some people don’t know is that even unpaid parking tickets can be reported to credit bureaus. Then there are cases where people visited a medical facility but were not handed over a bill. Some facilities tend to send the invoice to your home, especially for those treatments which may not be covered under OHIP or your insurance. You may miss on those bills if your address on or OHIP Card or other systems is not correct. There are many cases when many people received a shocker as their unpaid medical bills were reported to Credit bureaus leading to a very poor credit rating. The bottom-line being: always promptly update your address in all your documents once you move. For those who are willing to pay a fee, Canada post provides a mail forwarding service when you change your address.

Optimize your outstanding credit balance: This appears counter-intuitive at first but you are best placed not to use more than 30% of the credit limit that you cumulatively possess on all your credit facilities. Cumulative credit limit here means the total of the credit limit that you possess on say two different credit cards i.e. $5000 is your total credit limit if you possess two credit cards with a limit on first one being $3000 and $2000 on second one.

30% of $5000 = $1500. Thus you should aim to utilise around 30% or $1500 of your credit limit. That’s the sweet spot that Credit Bureaus think in terms of credit utilization ratio. If you use more than 50% of your credit limit, your score will start hurting bad. It kind of feels odd to have a credit limit and not use it fully. Such a structure certainly works in the favour of banks as this makes people get more credit cards.

If your credit utilization needs are higher, it makes sense to get another credit card so that your total credit limit increases. Most banks have a mechanism of increasing the credit limit on your card on a periodic basis like once in six months to a year- if your payment history is satisfactory. You can also call up your bank and ask for a credit limit increase. Since the credit utilization ratio has a weightage of 30% towards your credit score, you can quickly improve your credit score by following these tips.

Do not close old credit accounts: All of us tend to search for the best possible deal and that’s how we get another credit card when the opportunity presents itself. Because maintaining so many credit accounts is a hassle and some of us do not think twice before closing the undesirable accounts. The only problem being that 15% of your credit history is dependent upon the length of your credit history. This also implies that you should be more cautious about the credit card that you choose as chances are that you will be stuck with it. If it requires an annual fee, the cost of maintaining a less used card would be considerable in the long run and you would not want to close it in order to preserve your credit history. Online and offline world is replete with commission focused agents pushing credit cards. Unfortunately, due to selective information disclosure by the agents, it is your task to really read the boring Terms & Conditions before you sign.

Limiting credit inquiries: Whenever a lender or an authorised agency makes a request to access your credit report as part of a loan/credit application process, it becomes a ‘hard inquiry’ into your account. Too many hard inquiries negatively impact your score since it signifies that you are desperately looking for credit. If you are looking for a car or home loan, try to get your quotes from different lenders within a 2 week period. That way all the inquiries will be counted as a single one. A hard inquiry becomes a part of your credit record for 36 months.

Be extremely wary of filling any applications or giving assent to an online or third party to check your scores. They may sell your information to other agencies who in turn might make hard inquiries on your account. Limit the number of times you apply for credit and only use trustworthy channels.

‘Soft inquiry’ are credit checks that don’t impact your credit score. It can be you requesting your own credit report or businesses asking for your credit information to pre-approve you for offers. Soft inquiry history is only visible to you except insurance companies and debt settlement companies. Insurance companies may be able to see other insurance company inquiries.

With 10% weightage given to this factor, you have to be careful to limit credit inquiries if you are aiming for an excellent score.

Access different types of credit facilities: Most of us own a credit card but not all of us have a line of credit or history of a loan facility, especially for a new immigrant to Canada. If you want to achieve an excellent credit score by the time you apply for a mortgage loan, you may want to create a credit history for other loans like an auto loan. Your history of repayment of these credit facilities is perceived well by the Credit Bureaus. With 10% of the weightage given to this factor, it is an important step to reach the highest credit scores.

Other things you can do to improve your credit score

Rectify errors: Regularly order your credit report and scan it for errors. It is possible to get them rectified by making your case.

Restrict multiple loan queries: Do not seek multiple credit facilities at the same time like a car and house loan.

Get a secured card: If you are not eligible for an unsecured credit card, apply for a secured one. A secured card is when you have to provide a security deposit to the Credit Card agency in order to make yourself eligible for a credit card. That is a good way to build a credit facility.

Become an authorised User: Becoming an authorised user on someone else’s credit card is a good strategy to improve your credit scores quickly. It really helps if the primary holder whose credit card account it is, has a good payment history. This specifically works better when your credit score is low on account of a short period of history like being a recent immigrant. To become an authorised user, the primary holder needs to send you a credit card with your name on it- typically like an add on card.

Conclusion

Hope the article was insightful. Lack of quality advice and information is the key reason why people have bad credit scores. But once you know these tips, it is easy to build an excellent score quickly. Do not forget to subscribe to Experli below so that you can find our next article right in your inbox. Thanks for reading!!