Everything you need to know about First Time Home Buyer Incentive Program

If you are new to Canada and yet to own a home, you might want to read further. The First Time Home Buyer Incentive (FTHBI) is a new incentive scheme launched by the Federal Government in March 2019 to help first time home buyers. The incentive is aimed at improving affordability for first time home buyers looking to buy a home. Federal Government has marked $1.25 billion for the next three years targeted at helping 100,000 families buy their first home.

What is First Time Home Buyer Incentive?

FTHBI incentive enables qualified first time buyers to reduce their monthly mortgage payment without increasing their down payment. It is also known as a shared equity plan as effectively the government will offer to:

- Pay 5% for a first time buyer’s purchase of a re-sale home

- Pay 5% to 10% for a first time buyer’s purchase of a new construction

It is called shared equity mortgage program as the government is going to share the gains or losses in your home’s value as it may fluctuate. The program will be run by Canada Mortgage Housing Corporation which will offer 10% towards downpayment for a new construction home and 5% for a re-sale home- interest free.

Do you have to payback the incentive and if yes how much?

Yes, the incentive is designed to increase your affordability by supporting your down payment needs but you are expected to pay it back later. You can either pay the incentive back after 25 years or when the property is sold- whatever happens first. Repayment of the incentive would not incur any pre-payment penalty. How much exactly you pay would depend upon the fair market value of the property.

If you were financed 5% for a resale home, you payback 5% of the value of the property value at the time of sale or repayment. Assuming you bought a condo for 400k, 5% of 400k= 20k- the amount of FTHBI allowed for a resale property. Suppose you sell it for 800k in 20 years, you have to pay back 5% of 800k = 40k. In case the value falls to 300k you would have to payback 5% of 300k= 15k.

Am I eligible for First Time Home Buyer Incentive?

Rules around your eligibility:

- Canadian citizens, permanent residents and those who are legally authorized to work in Canada.

- At least one borrower must be a first time homebuyer.

- Your maximum qualifying income must be $120,000 or less.

- Your total borrowing is limited to 4 times the qualifying income.

- You should have the minimum required down payment for buying the property.

First time home buyer requirement:

At least one homeowner must be a first-time homebuyer, which is considered as the following:

- Have never purchased a home before

- Have gone through a breakdown of marriage or common-law partnership (even if the other first-time home buyer requirements are not met)

- In the last 4 years did not occupy a home that was occupied by the homebuyer or their spouse

IMPORTANT: It’s possible that you or your spouse or common-law partner qualifies for the First-Time Home Buyer Incentive (if you are in a married or common-law relationship) with the 4-year clause

even if you’ve owned a home.

Rules around the properties:

- Investment properties are not eligible for funding. You need to occupy the property and cannot rent it out. There might be exceptions though in case of hardships.

- New construction homes, re-sale homes and new and re-sale mobile/manufactured homes

- Type of residential properties eligible are single family homes, semi-detached homes, duplex, triplex, fourplex, town houses and condominium units.

- The property must be located in Canada and must be suitable and available for full time, year round occupancy.

You may use this calculator to check your eligibility.

How much would you save?

As per the government estimates, you could save $286 per month ($3,430 per year) in mortgage payments on a $500,000 house.

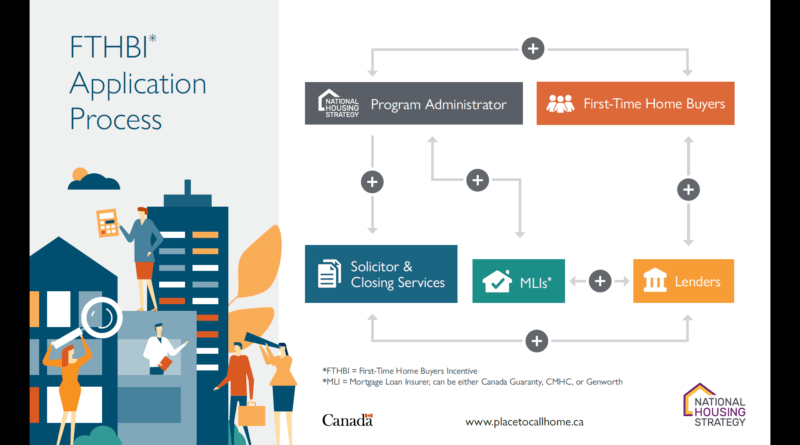

How can i apply?

The program will be ready to receive incentive applications on September 2, 2019 with the first closing expected on November 1 2019. Following are the steps to apply:

Step 1: Read, print and sign the Information Package together with the Canada’s FTHBI Program Attestation, Consent & Privacy Notice both available on www.placetocallhome.ca/fthbi.

Step 2: Take the executed Canada’s FTHBI Program Attestation, Consent & Privacy Notice with you to your first mortgage lender/mortgage broker.

Step 3: The first mortgage lender/mortgage broker will submit the application to the Program Administrator on your behalf and at your request.

Contact the First-Time Home Buyer Incentive information line at 1-877-884-2642 for more details about the program.

Thanks for helpful share! I would suggest this post for all home buyer for the first time.